Guidelines for banks for resolution of COVID-19-related stressed assets in 26 sectors released

September 8, 2020

- Guidelines for banks for resolution of COVID-19-related stressed assets in 26 sectors Released by Reserve Bank of India (RBI) on September 7, 2020. These 26 sectors include aviation, tourism and auto components.

- The resolution plan is based on the recommendations of the KV Kamath Committee, which submitted its report on September 4, 2020.

Revised Priority Sector Lending Guidelines recently released by RBI

September 7, 2020

- Revised Priority Sector Lending Guidelines recently released by RBI by giving higher weightage to incremental priority sector credit in ‘identified districts’ where priority sector credit flow is comparatively low.

New guidelines on PSL released by RBI

September 5, 2020

- The Reserve Bank of India (RBI) recently released revised priority sector lending guidelines.

- New categories eligible for finance under the priority sector now include:

- Bank finance of up to ₹50 crores to start-ups,

- Loans to farmers so as install solar power plants for solarisation of grid-connected agriculture pumps,

- Loans for setting the compressed biogas (CBG) plants

Innovation Hub for the financial sector

August 9, 2020

- The Reserve Bank of India (RBI) is planning to set up an Innovation Hub.The aim of this Innovation Hub is to promote innovation across the finance sector in India by using technology.

RBI extended an amount of $400 Million Currency Swap Facility to Sri Lanka

July 27, 2020

- The Reserve Bank of India has signed and gave the confirmation for extending a USD 400 million currency swap facility to Sri Lanka to boost the island nation’s draining foreign exchange reserves due to the coronavirus pandemic.

- The currency swap arrangement will remain available until November 2022.

RBI starts Report of Committee For Analysis of QR Code led by Prof. Deepak B Phatak

July 24, 2020

- On July 24, 2020, the Reserve Bank of India (RBI) publicized the “Report of the Committee for Analysis of QR (Quick Response) Code” under the leadership of Prof. Deepak B. Phatak on its website for comments/suggestions of various industry players.

- The committee has advised phasing out of proprietary, closed-loop QR codes as it requires customers to manage separate apps.

- The committee was constituted by RBI on 23rd december 2019.

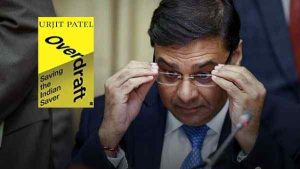

Former RBI governor Urjit Patel released book named ‘Overdraft: Saving the Indian Saver’

July 6, 2020

- ‘Overdraft: Saving the Indian Saver’, the book centers on the non-performing assets (NPAs) issue that has bothered Indian banking in contemporary years, its causes, and Urjit Patel’s efforts as the RBI Governor in dealing with it.

NCAER forecasts India’s GDP growth at 1.3% in FY21

June 28, 2020

- National Council of Applied Economic Research (NCAER) announced the Indian economy could be developing at 1.3% in FY21 as a base case scenario. This prediction is based on the incorporation of the monetary and fiscal stimulus measures undertaken by the Reserve Bank of India (RBI) and the central government.

Cooperative banks to be drawn under RBI supervision

June 24, 2020

- The Union Cabinet permitted the inclusion of co-operative banks under supervisory controls of the Reserve Bank of India while declaring a Rs 1,542 crore year-long interest subvention scheme for microloan borrowers.