HSBC to set up IFSC Banking Unit at GIFT city in Gandhinagar

July 16, 2020

- HSBC- the Hongkong and Shanghai Banking Corporation Limited is to set up the IFSC Banking Unit at Gujarat International Finance Tec City, GIFT city in Gandhinagar Gujarat.

- This development marks a major milestone for HSBC in India, which has been present in the country for more than 160 years.

‘Digital Choupal’ campaign started by NABARD on its 39th foundation day

July 15, 2020

- National Bank for Agriculture and Rural Development (NABARD) has celebrated its 39th Foundation day on 12th July

- NABARD has organized its first “digital choupal”, a video conference which brought together farmers from across the country who have been associated with NABARD in different rural projects.

- NABARD has also announced Rs 5,000 crore of refinance scheme for banks and financial institutions for providing finance to the beneficiaries of its 2,150 watershed development projects and also earmarked another Rs 5,000 crore for turning Primary Agricultural Credit Societies (PACS), into multi service centres.

Visa Partners with Federal Bank to Deploy Visa Secure to the Bank’s Cardholders

July 14, 2020

- Visa, enters into partnership with Federal Bank to deploy Visa Secure to the bank’s cardholders.

- Visa Secure will provide additional authentication layers for issuers and merchants to combat online frauds.

- This partnership will enhance the focus of the bank on customer-centric digital solutions that make online shopping experiences seamless.

Equitas Small Finance Bank starts video KYC account

July 8, 2020

- Equitas Small Finance Bank Limited has started a facility for opening an account through video KYC.

- With this, any person anywhere in the country can initiate a savings account with Equitas Small Finance Bank; complete the full KYC through video with the Bank employee.

Karur Vysya Bank pairs-up with Star Health Insurance

July 8, 2020

- The Karur Vysya Bank (KVB) on 6th July declared it has entered into a pair-up with Star Health and Allied Insurance to provide health insurance products to its clients.

Fino Payments Bank starts ‘Bhavishya’ savings account for minors

July 8, 2020

- Fino Payments Bank Limited (FPBL) has started a savings bank account ‘Bhavishya’ for minor children aged between 10 and 18 years on 7th July 2020 to allow children banking ready from an early age and teach a savings habit among them.

SBM Bank India, Mastercard pairs-up to facilitate cross border remittances by Mastercard Send

July 7, 2020

- SBM Bank India (promoted by Government of Mauritius) and Mastercard have tied hands to facilitate cross-border payments and transmittals services by using ‘Mastercard Send’.

- Mastercard Send is a secured and innovative solution – crafted to improve domestic and cross-border payments and transmittals.

YES Bank starts ‘Loan in Seconds’ for instant loan disbursement

July 7, 2020

- YES Bank has started a digital solution, “Loan in Seconds” for instantaneous disbursement of retail loans.

- The account holders recognized by the bank can avail this swift loan disbursal convenience without any document.

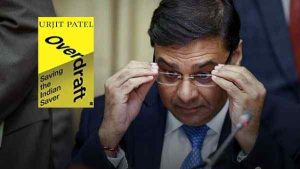

Former RBI governor Urjit Patel released book named ‘Overdraft: Saving the Indian Saver’

July 6, 2020

- ‘Overdraft: Saving the Indian Saver’, the book centers on the non-performing assets (NPAs) issue that has bothered Indian banking in contemporary years, its causes, and Urjit Patel’s efforts as the RBI Governor in dealing with it.